Financial literacy can safeguard your interests with self-advised rates and workflow plans.

It seems that the banks we trust the most are our weaknesses, as they hide the truth and pass down incomplete and un-statistical data.

At GoGetALife, we grant you external control over your expenses and tax exposure because we know the crucial pathway blocking your road to success is nothing but unreliable payment awareness. Experiencing financial literacy is not a choice but a need that should be addressed as promptly as possible. It is time people gather their conscience and use it wisely to develop lifelong skills.

Why Go for Financial Literacy Now?

Handling money and taxes has always been neglected and ignored in our economic settings. That is why learning cashflow concepts, financial freedom, and even simple payment algorithms seems so difficult. It is in demand for our security and stabilization that we seek financial literacy, at least to eliminate future heap steak.

- The Debt Trap: Having financial knowledge and a tax approval record will help you understand the loaning system better, saving you from unannounced debt threats.

- Valuable Opportunities: Banks or even your advisors, most of the time, fail to tell you dozens of cash-prizing opportunities, or more like they don’t want you to know. But with a strong taxing mindset, you can avail advantages you never dreamed of.

- Poor Decision-making: With zero aptitude for money handling, banks seem like they are offering a hell of an incentive but all of it is unhealthy embezzlement on their parts leading you into weak decisions.

- Unshakable Stress: Talking about finances is a stigma in our society, with financial literacy, you can break out of this scrutiny and share a strong vulnerability on how and when to use your income.

Strategizing the Financial Upbringing of Canadians

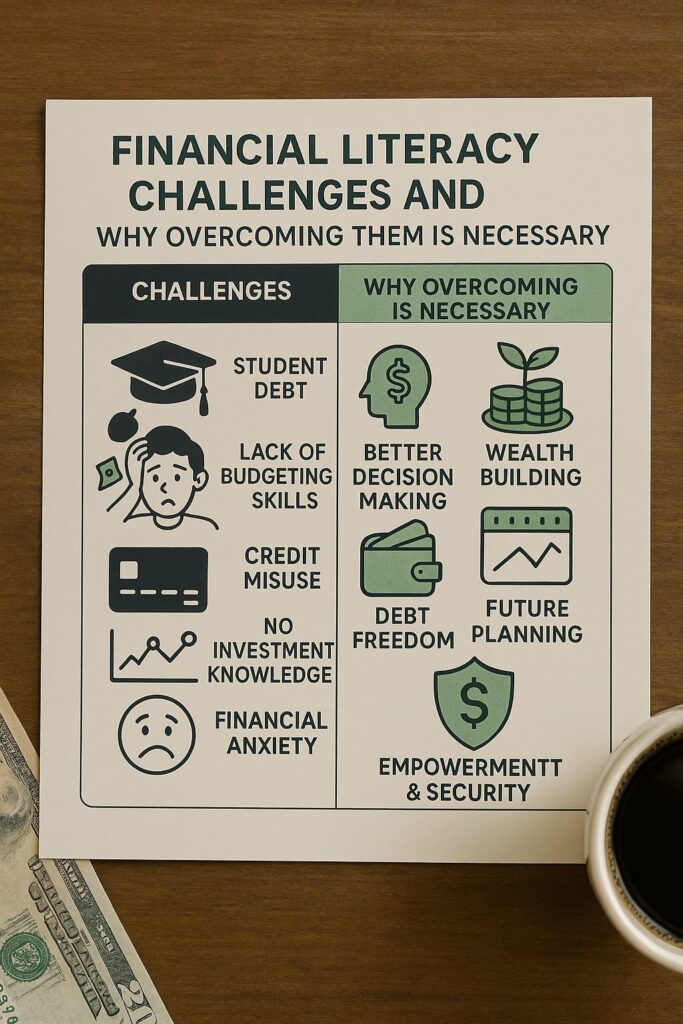

As per surveys and conclusions at the National level, balancing education and finances is a core requirement of today’s systems. The major priorities in obtaining financial literacy and a stable system are based on five fundamentals.

- Shared responsibility: This asks for sharing common grounds between stakeholders, financial providers, government, as well as employees all over, pertaining to healthy partnerships.

- Leadership and Collaboration: Despite management at a national level, strong leadership and meaningful collaboration within the upper and lower borders of a society are high in demand.

- Lifelong Learning: As described earlier, financial literacy is not a perk but a tool to bring momentum in the upcoming legacy as well, clearing money hurdles and forging advancement in financial education.

- Delivery and Promotion: Financial literacy is bound to an education system with prompt delivery and basic promotions involving evolution and changes from within.

- Accountability: To end with, programmed evaluation and record tracking are must-performed tasks regarding accountability and featured distribution of financial literacy for all primes.